Legacy Society

Page Anchor

Leave a Legacy That Will Last Forever

Supporters who have a passion for the arts, for community based theater, and The Naples Players can ensure that their love of the arts will live on for generations to come. A pre-planned legacy gift is one of the best routes for leaving a long term impact at The Naples Players (TNP). Legacy giving provides a level of support that magnifies our ability to fulfill our mission in the future, but it also multiplies your personal satisfaction and recognition today.

One of the best things about legacy gifts is that they don’t impact your current lifestyle or your family’s financial security – and can be done in honor of you, your family, or a loved one.

If you have already included TNP in your estate plans, please let us know! We would like to show our appreciation during your lifetime, and ensure your intentions are honored.

Society Benefits

- Permanent inclusion on The Naples Players Legacy Society register.

- An invitation to an annual dinner with the Artistic Director, performers, and board members exclusively held for members of The Naples Players Legacy Society.

- Special recognition in TNP Playbills, website, annual reports, and e-mails throughout the year.

- A special thank you gift, specifically for theater lovers.

A Gift Anyone Can Afford

A Planned Gift...

- Doesn’t cost you anything in your lifetime.

- Leaves your cash flow and current financial planning unchanged, increasing your ability to make a significant gift to The Naples Players.

- Allows you to eliminate income tax on your required IRA annual charitable distribution (If you are 70 ½ or older).

- Reduces future gift and estate taxes.

- Can be stock, appreciated securities, life insurance, or property instead of cash.

- Can allow you to create a new life insurance policy, or donate a paid-up policy of coverage you no longer need.

How to Join

Be sure to discuss all legacy options with your loved ones and please note that TNP does not render tax or legal advice. Please discuss your options with a lawyer, CPA, and/or financial advisor.

If you decide to include TNP in your estate planning, please complete and return our Confidential Legacy Society Intent Form so we can properly recognize you for your generosity and welcome you to The Naples Players Legacy Society.

Thank you to these donors

Our Legacy Society Members

See the names below to learn about their story and their gift to TNP:

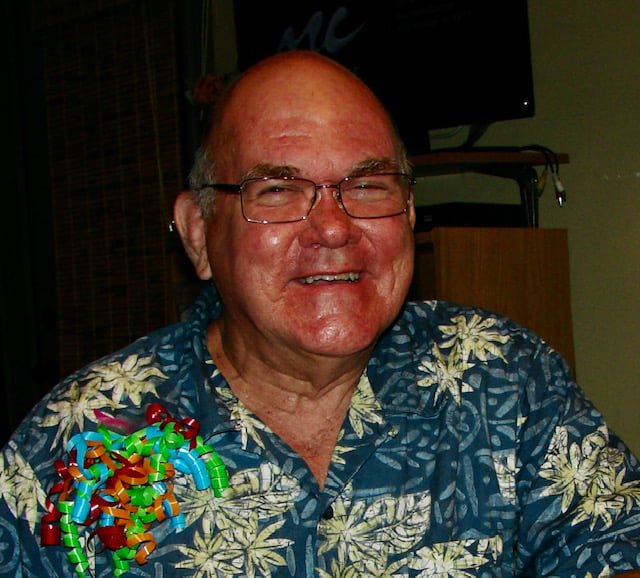

Roger F. Clark*

Robert W. “Bob” Hill*

Frances Lester

Charlie & Peg Pleasance*

Janine Rees

*Founding members

Popular ways to give

Also known as estate giving or planned giving, you would simply name The Naples Players in your will. A bequest can take the form of…

- A percentage of the donor’s estate

- A fixed dollar amount from the estate

- As a residual amount or percentage after other beneficiaries have been provided with their gifts.

Name The Naples Players as a partial or primary beneficiary of a policy. Either one is exempt from federal estate tax.

This would include a pension plan, 401k accounts, or an IRA. If you are 70 1/2 or older, you are required to take minimum distributions from your IRA account every year. You can make a qualified charitable distribution up to $100,000 tax free.

Stocks, bonds, mutual funds and other securities can be an attractive option for planned giving and offer special tax benefits. Congress has provided that you can deduct the full value of such gifts including any amount that would be owed in capital gains tax if sold.

In many states, it is possible to specify that whatever remains in bank accounts becomes a charitable gift that will pass free of estate tax and outside the probate process. This can be accomplished by filling out a simple change of beneficiary form.

Properties such as houses, farms, vacation homes, office buildings, undeveloped land, and rental property are common choices.

This would include automobiles, artwork, or other personal property.

This would be an intangible asset that refers to “creations of the mind” such as inventions, patents, copyrights, trademarks, trade secrets, artworks, musical compositions, and other similar or related property rights.